Innovative Educator

At Gilbert Stuart Middle School in Providence, Rhode Island, Nikhol Bentley uses games and guest speakers to show her middle school students how learning to manage their personal finances can expand their opportunities in life.

Nikhol was immersed into the world of personal finance when she was assigned to teach the class in 2017. With a background as a math teacher and little experience teaching personal finance, she sought out online resources and attended conferences to craft a comprehensive curriculum from scratch. In the first year, her semester-long course was initially taught to one group of students. But, word has spread about her innovative and engaging class, and this school year she will be teaching four classes of 6th and 7th grade students. Nikhol has taught over 500 students so far, and with school-wide presentations she is able to reach nearly 1,000 students and their families.

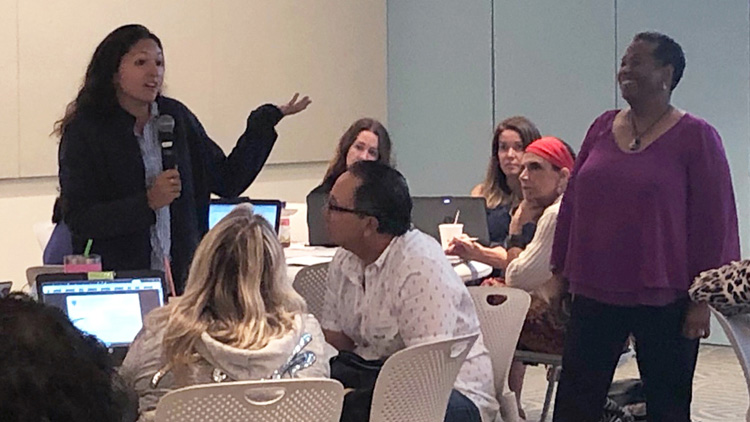

Nikhol speaks to other educators at an educator personal finance training.

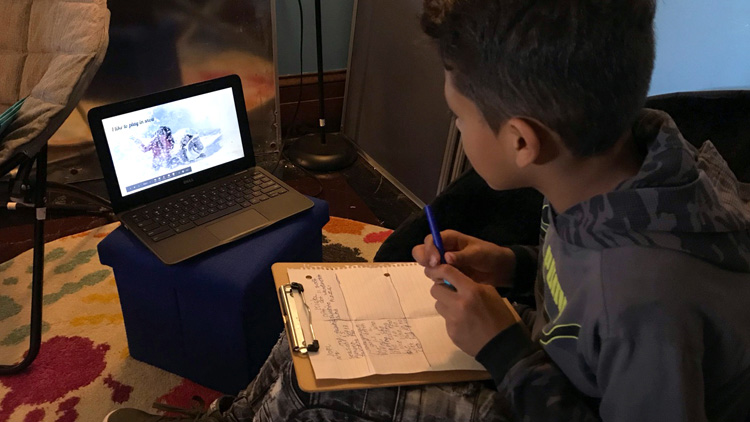

Nikhol's curriculum shows middle school students why personal finance skills are important; she relies on a mix of games, books and online resources to illustrate how financial health affects nearly every aspect of life. "I made up a needs vs. wants obstacle course relay race game to get my kids up and moving, running around and making noise. I use the games as an incentive to keep them focused," Nikhol explains. Her teaching space is also non-traditional, with warm lighting and bean bags instead of chairs and desks, which helps to take the pressure off learning about a complex topic.

Typically, only a few of Nikhol's students come into her class with a basic understanding of what financial literacy means. However, as the course goes on, students gain an understanding of how their money can be saved instead of spent right away. This knowledge can have a powerful impact on her students and their families. One student's parent told Nikhol that due to the personal finance education her daughter received, they were taking their finances more seriously and were saving up to buy a house.

Students sit in inflatable bean bags in Nikhol’s non-traditional teaching space.

"The problem is that a lot of their parents don't understand because they were never taught. It's a cycle," Nikhol says. She believes that personal finance skills should be taught early, and that they can be integrated with math lessons. For example, she uses paycheck math like determining the amount of money that will go towards taxes in a given period to teach students how to do conversions from decimals to percentages.

Nikhol also brings guest speakers into her class to offer students an additional perspective. United States Senator Jack Reed and General Treasurer of Rhode Island Seth Magaziner spoke to the students about their jobs and answered questions about local issues. The opportunity to meet such high-profile government officials expands the students' worldview and allows them to see the applications of what they learn in school. A member of the State Treasurer's office also came to class to play financial games with the students and to teach them about student loans.

A student works on an assignment on a laptop in Nikhol’s personal finance class.

The middle school students in Nikhol's class also embark on a mini-career planning project. They research potential career and higher education options and share with each other what they find. "Most kids don't think they need to plan for their future when they are 11, but they eventually realize it's fun," she explains.

In her class, Nikhol emphasizes the options that students have. "I think the most important thing is to be yourself. You have to pay your bills, but you get to choose what they are. All of the choices are in front of you, and no matter what your needs or wants are, everybody needs to learn how to manage their money," she says.

A student watches a video and takes notes in Nikhol’s personal finance class.

The curriculum that Nikhol put together has been effective. Not only do her students have an enhanced appreciation for the importance of personal finance, but they placed first in Jump$tart's 2019 EconChallenge and earned third place in the Personal Finance Challenge.

Practical Money Skills would like to commend Nikhol Bentley on her ongoing efforts and commitment to financial literacy at Gilbert Stuart Middle School.

Nikhol uses games to illustrate personal finance concepts to her middle school students.

Share